The landscape of cannabis laws in Massachusetts has evolved significantly since the state legalized medical marijuana in 2013 and recreational use in 2018. Understanding the current regulations is crucial for residents and visitors alike. This article delves into the nuances of the state’s cannabis laws, including the distinctions between medical and recreational use, the economic impact of cannabis sales, and the future outlook for marijuana legislation in Massachusetts.

Key Takeaways

- Massachusetts has legalized both medical and recreational marijuana, with a robust sales record of $1.8 billion in 2023.

- Adult residents can possess up to 1 oz of marijuana in public and up to 10 oz at home, and can cultivate up to 6 plants per person.

- Medical marijuana cardholders in Massachusetts benefit from tax exemptions, potentially saving up to 20% on cannabis purchases.

- The state has a strong network of 400 licensed dispensaries offering a wide range of cannabis products, with no tax on medical-use marijuana.

- Ongoing reforms may further shape the legal landscape, including potential changes to marijuana laws and the exploration of psychedelics policy.

Understanding the Legal Landscape of Cannabis in Massachusetts

The Journey to Legalization

The path to legalizing marijuana in Massachusetts has been marked by significant milestones and public advocacy. Voter initiatives and legislative actions have both played crucial roles in shaping the state’s approach to cannabis regulation.

Key developments include:

- The decriminalization of small amounts of marijuana in 2008.

- The legalization of medical marijuana in 2012.

- The historic vote in 2016 to legalize recreational marijuana for adults over the age of 21.

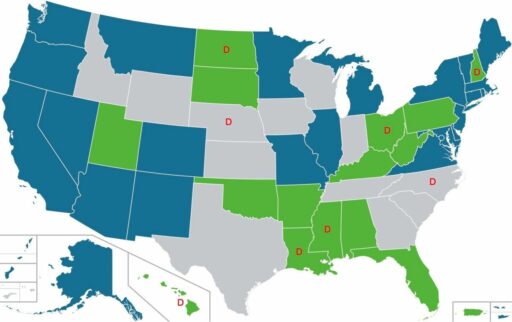

The evolution of cannabis laws in Massachusetts reflects a broader trend towards acceptance and regulation of marijuana across the United States.

As the legal framework continues to evolve, stakeholders such as businesses, consumers, and government entities are adapting to the new landscape. The state has worked to balance public health concerns with the economic opportunities presented by the cannabis industry.

Recreational vs. Medical Use Regulations

In Massachusetts, the regulations governing recreational and medical cannabis are distinct, each with its own set of rules and benefits. Recreational cannabis users are limited to purchasing and possessing 1 oz of marijuana, whereas medical patients may possess up to 10 oz every 60 days. This difference underscores the state’s approach to addressing the needs of patients seeking therapeutic benefits from cannabis.

The state’s regulatory framework ensures that both Marijuana Establishments and Medical Marijuana Treatment Centers provide tested products with clear labeling, contributing to the safety and informed choices of consumers.

For recreational users, the purchase of adult-use marijuana incurs a state tax rate of 17-20%. In contrast, medical patients are exempt from this tax, leading to significant savings. Additionally, medical cardholders enjoy benefits such as skipping dispensary lines, access to higher potency strains, and enhanced legal protection.

Here is a summary of the key differences:

| User Type | Possession Limit | Purchase Limit | State Tax |

|---|---|---|---|

| Medical Patients | 10 oz/60 days | 10 oz | 0% |

| Recreational Users | 1 oz | 1 oz | 17-20% |

Understanding these regulations is crucial for individuals navigating the cannabis landscape in Massachusetts, whether for recreational enjoyment or medical relief.

Possession, Cultivation, and Consumption Rules

In Massachusetts, the rules surrounding possession, cultivation, and consumption of cannabis are distinct for recreational and medical use. For recreational users, the law permits the purchase of up to 1 oz of marijuana from licensed dispensaries and allows possession of up to 10 oz within a private residence. Public consumption remains illegal, as does use on federal land.

Medical marijuana patients enjoy greater liberties, with a possession limit of 10 oz for a 60-day period. Cultivation laws are also in place, providing individuals the ability to grow marijuana for personal use under specific guidelines.

The state’s approach aims to balance individual freedoms with public safety and federal regulations.

Economic incentives exist for medical users, who are exempt from the state’s cannabis tax, which ranges from 17-20% for recreational products. This tax exemption, coupled with higher purchase and possession limits, underscores the benefits of obtaining a medical marijuana card in Massachusetts.

Implications for Employers and Landlords

With the legalization of marijuana in Massachusetts, employers and landlords face a new set of challenges and responsibilities. Employers must navigate the complexities of marijuana use among employees, particularly in relation to job performance and workplace safety. The state mandates that employers adhere to both federal and state laws, which can often present conflicting requirements. For instance, while marijuana is legal in Massachusetts, it remains illegal under federal law, affecting businesses that receive federal funding or are subject to federal regulations.

Landlords, on the other hand, have to consider the implications of marijuana use and cultivation on their properties. They must balance the rights of tenants with the need to maintain a safe and compliant environment for all residents. This includes decisions about allowing or prohibiting marijuana use on the premises and handling potential conflicts between tenants.

The intersection of state legalization and federal prohibition creates a complex legal environment for employers and landlords in Massachusetts.

Here are some key points for employers and landlords to consider:

- Understanding the legal rights of employees and tenants regarding marijuana use

- Developing clear policies that comply with both state and federal laws

- Addressing safety concerns related to on-the-job impairment

- Navigating the legal landscape for businesses involved in the marijuana industry

Navigating the Medical Marijuana Program

Qualifying Conditions for Medical Use

In Massachusetts, the eligibility for a medical marijuana card is determined by a set of specific qualifying conditions. These conditions include serious ailments such as Amyotrophic Lateral Sclerosis (ALS), cancer, and multiple sclerosis, among others. Additionally, the state permits the inclusion of other severe conditions that a certified medical marijuana doctor acknowledges as significantly limiting major life activities.

The process for obtaining a medical card involves a consultation with a licensed physician, who must certify the patient annually. This certification is a crucial step in ensuring that only those with legitimate medical needs have access to cannabis for therapeutic purposes.

The inclusion of anxiety as a qualifying condition reflects the state’s recognition of the broad therapeutic potential of cannabis. This progressive stance opens the door for many patients seeking alternative treatments for their mental health.

The Medical Marijuana Card Application Process

Applying for a medical marijuana card in Massachusetts is a streamlined process. Residents can now register online without the need for a paper application. The essential requirements include a written recommendation from a registered doctor, a valid state ID, a passport-style photo, and a unique PIN obtained after certification.

Once approved, patients receive a temporary recommendation allowing immediate access to dispensaries. This temporary number is used to complete the registration with the Medical Use of Marijuana Program.

The online system simplifies the process, ensuring patients can quickly obtain their medical marijuana card and begin their treatment without unnecessary delays.

Patients enjoy significant benefits, such as being exempt from the 17-20% excise tax and having higher purchase limits, leading to considerable savings in both money and time.

Benefits of Holding a Medical Marijuana Card

Holding a medical marijuana card in Massachusetts offers a range of advantages that are not available to recreational users. Cost savings are a significant benefit, as medical patients are exempt from the state excise tax ranging from 17-20%. This can translate to substantial financial savings over time.

In addition to tax exemptions, medical cardholders enjoy greater purchase and possession limits. While recreational consumers are limited to 1 oz, medical patients can possess up to 10 oz for a 60-day period. This increased limit supports those with more substantial medical needs.

Another key advantage is access to higher potency strains, which can be crucial for patients with specific medical conditions requiring stronger treatment options. Moreover, medical cardholders often experience shorter wait times at dispensaries and have enhanced legal protections.

The benefit of having a medical marijuana card is unmistakable; it can enhance your medical treatment options and provide peace of mind with greater legal safeguards.

Lastly, the process of obtaining a medical marijuana card in Massachusetts is straightforward, with an intuitive online platform and support available, making it accessible for those who qualify.

Medical Marijuana Tax Exemptions

In Massachusetts, the financial benefits for medical marijuana patients are significant. Medical-use marijuana is exempt from the state’s marijuana taxes, which includes the state sales tax of 6.25%, the state excise tax of 10.75%, and the local option tax of up to 3%. This exemption is applicable when patients present their Medical Use of Marijuana Program ID Card along with a valid government-issued identification at the time of sale.

The tax exemption for medical marijuana can lead to substantial savings for patients. For example:

| Tax Type | Recreational Users | Medical Patients |

|---|---|---|

| State Sales Tax | 6.25% | 0% |

| State Excise Tax | 10.75% | 0% |

| Local Option Tax | Up to 3% | 0% |

The exemption from these taxes, coupled with the ability to purchase up to 10 times the amount allowed for recreational users, results in considerable cash and time savings for those enrolled in the medical program.

It’s important to note that these exemptions are designed to ensure that patients who require marijuana for medical purposes are not financially burdened by the additional taxes levied on recreational use.

Economic Impact of Cannabis Sales in Massachusetts

Record-Breaking Sales Figures

Massachusetts witnessed a remarkable surge in cannabis sales, culminating in a record-breaking December with $158.7 million in legal cannabis products sold. This impressive monthly figure contributed to the state’s total sales for 2023, which reached nearly $1.8 billion, according to the Cannabis Control Commission.

The consistent growth in cannabis sales underscores the thriving market in Massachusetts, reflecting a robust demand and a maturing industry.

The table below summarizes the sales milestones achieved by Massachusetts in 2023:

| Month | Sales Figures |

|---|---|

| December | $158.7 million |

| Total for 2023 | $1.8 billion |

These figures not only highlight the economic significance of the cannabis industry in the state but also point to the potential for future market expansion and the increasing acceptance of cannabis within the regulatory and consumer landscapes.

Tax Revenue and Rate Structure

The taxation of cannabis in Massachusetts is a significant contributor to the state’s revenue. Adult-use marijuana is subject to multiple taxes, including a state sales tax, a state excise tax, and a local option tax that cities or towns can impose. These taxes are layered on top of the purchase price, creating a structured revenue stream for the state.

The combined tax rate for adult-use marijuana can reach up to 20.75%, which includes the state sales tax of 6.25%, a state excise tax of 10.75%, and a local option tax of up to 3%. This rate is competitive compared to other states and is designed to balance between generating revenue and keeping legal markets attractive compared to illicit ones.

Medical-use marijuana, on the other hand, is exempt from these taxes, provided that patients present their Medical Use of Marijuana Program ID Card. This exemption underscores the state’s commitment to ensuring that medical patients have affordable access to their medication.

Projected Growth and Market Expansion

The cannabis industry in Massachusetts is poised for significant growth, with recent data indicating a robust expansion trajectory. Massachusetts set a marijuana sales record in December, with total purchases in 2023 reaching $1.8 billion. This figure not only reflects the state’s increasing acceptance and integration of cannabis into the mainstream economy but also suggests a promising future for market expansion.

The industry’s growth is underpinned by a well-regulated environment that fosters economic development, job creation, and safe access to both adult- and medical-use marijuana.

With a steady increase in the number of provisional licenses being granted, such as those to Community Growth Partners Boston, LLC and Burn Bright, LLC, the infrastructure for cannabis sales is strengthening. The open data on sales and product distribution further underscores the potential for a flourishing cannabis economy in the Commonwealth.

| Year | Total Marijuana Sales in Massachusetts |

|---|---|

| 2023 | $1.8 Billion |

The projected growth is not just a matter of revenue; it also encompasses the diversification of products, the geographical spread of dispensaries, and the sophistication of consumer preferences. As the market matures, we can expect to see a more nuanced and dynamic cannabis industry emerge in Massachusetts.

Access to Cannabis: Dispensaries and Products

Number and Distribution of Licensed Dispensaries

As of the latest data, Massachusetts boasts a robust network of 400 licensed dispensaries. This number reflects the state’s commitment to ensuring that both medical and recreational users have access to cannabis products. The dispensaries are strategically distributed across various cities and towns, catering to the needs of residents throughout the state.

The average price for cannabis products in Massachusetts is approximately $5.68 per gram, with an average ounce costing around $284. This pricing reflects the market’s response to the supply and demand dynamics within the state.

The distribution of dispensaries is designed to provide equitable access to all residents, with a focus on convenience and product availability.

Here’s a quick overview of the number of licensed entities involved in the cannabis industry:

- Dispensaries: 400

- Cultivators and Processors: 117

These figures underscore the scale of the cannabis industry in Massachusetts and its potential for continued growth.

Range of Products Available to Consumers

In Massachusetts, consumers have access to a wide range of cannabis products that cater to various preferences and needs. The state’s dispensaries offer an assortment of items, from the traditional dry cannabis flower to more innovative forms like edibles, concentrates, tinctures, pre-rolls, topicals, and vapes. All formulations of cannabis are available, ensuring that both recreational and medical users can find products that suit their requirements.

The average price for marijuana products in Massachusetts is about $5.68 per gram, with an average ounce costing around $284. This pricing reflects the market’s response to consumer demand and the regulatory environment.

The table below provides a snapshot of the cannabis product landscape in Massachusetts:

| Product Type | Description |

|---|---|

| Dry Cannabis Flower | Traditional inhaled product, various strains |

| Edibles | Ingestible items with THC, such as gummies |

| Concentrates | High-potency extracts for dabbing or vaping |

| Tinctures | Liquid extracts for sublingual use |

| Pre-rolls | Ready-to-smoke cannabis cigarettes |

| Topicals | Cannabis-infused creams and balms for topical use |

| Vapes | Cartridges and pens for vapor inhalation |

It’s important to note that while the market is thriving with these legal products, there are concerns about unregulated items that are dangerous and intoxicating and do not meet the state’s safety standards. These unregulated products can pose a risk to consumer safety and create unfair competition for legal dispensaries.

Pricing and Affordability of Cannabis Products

The pricing of cannabis products in Massachusetts reflects a competitive market, with the average cost of marijuana hovering around $5.68 per gram. This affordability is partly due to the state’s robust number of licensed dispensaries, which stands at 400, offering a wide range of products from dry cannabis flower to edibles and concentrates.

The all-time low prices are indicative of a maturing market that benefits consumers, especially as the state witnesses record sales figures.

Here’s a quick glance at the current pricing landscape:

| Product Type | Average Price per Gram |

|---|---|

| Dry Flower | $5.68 |

| Edibles | Varies by product |

| Concentrates | Varies by product |

| Tinctures | Varies by product |

Consumers can also find a variety of payment options and flexible pricing through partnered dispensaries, ensuring that medical cannabis is accessible to those who need it. With the state’s commitment to a well-regulated industry, Massachusetts continues to provide safe and affordable access to both adult-use and medical marijuana.

Future Outlook and Ongoing Reforms

Potential Changes to Marijuana Laws

As Massachusetts continues to adapt to the evolving landscape of cannabis legislation, several potential changes to marijuana laws are on the horizon. Legislative efforts are underway to refine and expand the legal framework, addressing issues from social equity to the integration of new research findings into policy.

- Congressional leaders have introduced a bill to extend state medical marijuana protections and to study various legalization models.

- Discussions are in progress to streamline the implementation of legalization measures, with a focus on social equity licenses.

- There is ongoing debate about the inclusion of psilocybin legalization provisions in broader drug policy reforms.

The potential changes aim to balance the interests of consumers, businesses, and public health, ensuring that the state’s cannabis laws remain responsive to societal needs and scientific insights.

While the future of marijuana laws in Massachusetts is not set in stone, the state is poised to continue its role as a leader in thoughtful cannabis regulation and reform.

Psychedelics and Broader Drug Policy Reforms

Massachusetts is on the cusp of significant reforms in drug policy, particularly concerning psychedelics. A legislative committee has recently advanced a bill to legalize psilocybin therapy, setting the stage for licensed facilitators to oversee its medical and therapeutic use. This move aligns with a broader trend of reevaluating the potential benefits of psychedelic substances.

The state is also considering an activist-backed legalization initiative that could transform access to psychedelics. If approved by lawmakers, this initiative would establish a regulatory framework for supervised access to substances like psilocybin and ayahuasca at licensed facilities.

The focus on psychedelics extends beyond legislative measures, with Governor Maura Healy introducing a bill to study the therapeutic potential of these substances, particularly for veterans.

In addition to these developments, there is a growing conversation around the therapeutic effects of synthetic psychedelics, such as MDMA, with proposals for comprehensive studies to explore their potential.

The Role of Public Opinion and Advocacy

The trajectory of marijuana laws in Massachusetts is significantly influenced by public opinion and advocacy efforts. As the state navigates the complexities of cannabis regulation, the voices of citizens and advocacy groups have become pivotal in shaping policy.

Public advocacy has been instrumental in initiating dialogues around the legalization and regulation of cannabis. For instance, the Massachusetts psychedelic ballot initiative, which aims to decriminalize certain psychedelic substances, is currently under lawmaker scrutiny. This initiative reflects a broader trend of public-driven efforts to reform drug policies.

The role of advocacy is not limited to pushing for new legislation; it also encompasses educating the public, providing support for those affected by current laws, and ensuring that the implementation of laws aligns with the community’s needs.

Lawmakers, influenced by advocacy groups and public sentiment, are more likely to consider reforms that align with the evolving perspectives of their constituents. The table below outlines the key areas where public opinion and advocacy have had a notable impact:

| Area of Impact | Description |

|---|---|

| Legislative Initiatives | Initiatives like the psychedelic ballot are a direct result of advocacy. |

| Education and Support | Advocacy groups provide crucial information and support to the public. |

| Law Implementation | Ensuring laws are implemented in a way that serves the community’s best interests. |

Conclusion

In summary, Massachusetts has made significant strides in cannabis legalization since the voter referendum in 2013. With both medical and recreational marijuana legalized, the state has established a robust legal market, as evidenced by the record sales of nearly $1.8 billion in 2023. While the state does not recognize out-of-state medical marijuana cards, it allows adults over the age of 21 to purchase and possess cannabis, with specific regulations in place for public consumption and home cultivation. Taxation policies have been implemented to differentiate between medical and recreational use, providing tax savings for medical patients. As the industry continues to evolve, Massachusetts residents and visitors alike must stay informed about the ongoing changes and the implications of federal law, which still classifies marijuana as a Schedule 1 narcotic. The state’s approach to cannabis regulation serves as a dynamic model of the complex interplay between state innovation and federal restrictions.

Frequently Asked Questions

Is marijuana legal for recreational use in Massachusetts?

Yes, recreational marijuana use is legal in Massachusetts since the state legalized it in 2018.

How much recreational marijuana can I legally possess in Massachusetts?

You can legally possess up to 1 ounce of marijuana on your person and up to 10 ounces in your home in Massachusetts.

Can I grow marijuana at home in Massachusetts?

Yes, Massachusetts residents aged 21 years or older may grow up to 6 plants per person at home.

Are there medical marijuana tax exemptions in Massachusetts?

Yes, the sale of medical-use marijuana is not subject to tax in Massachusetts if patients present their Medical Use of Marijuana Program ID Card.

How many medical marijuana patients are there in Massachusetts?

As of the second half of 2023, Massachusetts surpassed 100,000 medical marijuana patients.

What are the tax rates for adult-use marijuana in Massachusetts?

Adult-use marijuana in Massachusetts is subject to a state sales tax of 6.25%, a state excise tax of 10.75%, and a local option tax of up to 3%.